Approach

We provide sophisticated financing solutions by leveraging our “deal champion” strategy, our proprietary capital tracking system “The Eye” and our 100% dedicated resource model- this allows us to act as our clients’ ‘outsourced’ CFO organization and help grow their platforms.

We are consistently thinking multiple steps ahead to create various paths to success.

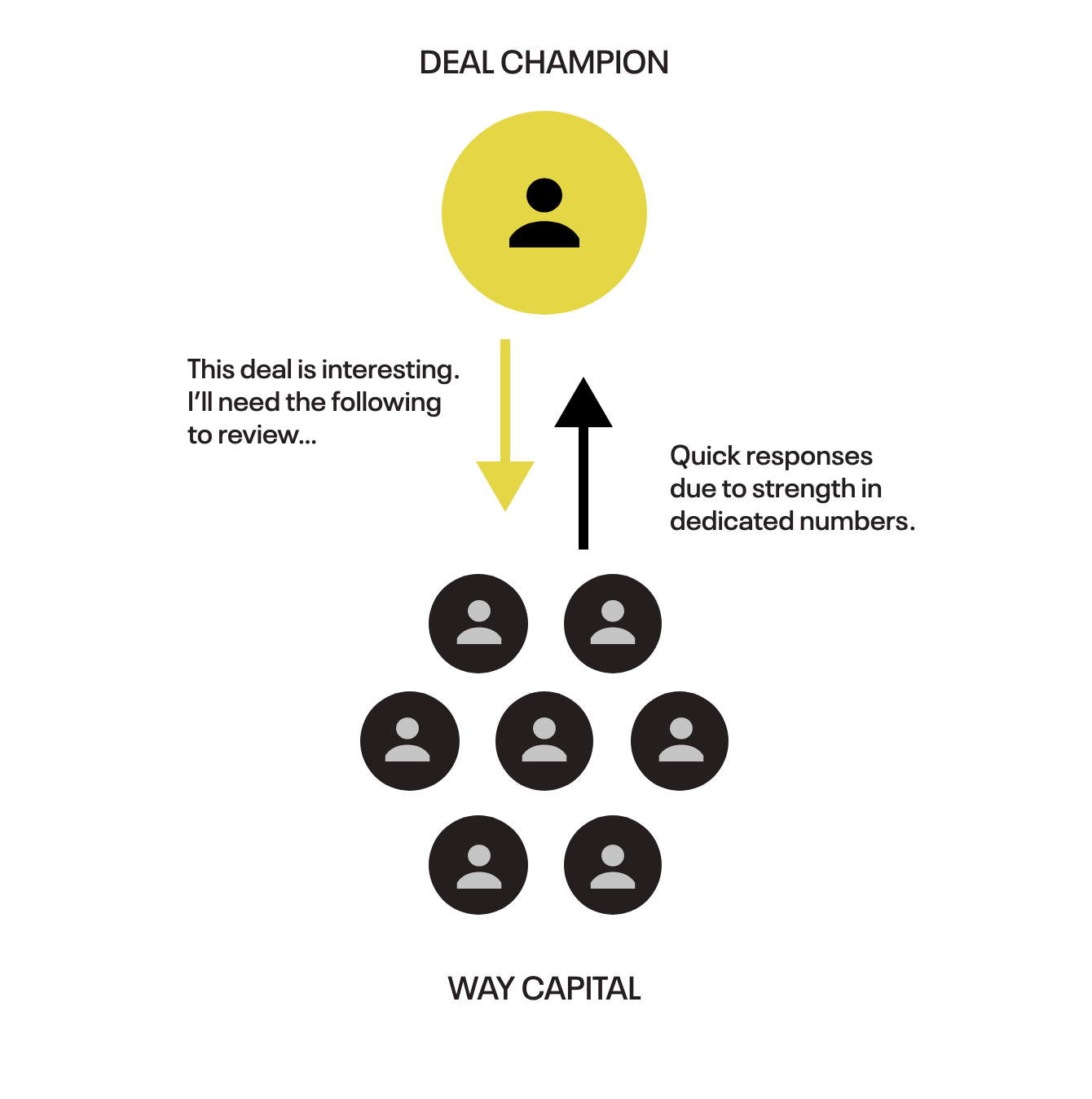

Deal Champion Strategy

Get your deal in front of decision makers.

Our team is focused on identifying “deal champions” within capital provider platforms and arming them with the information needed to confidently pitch our deals to their investment committees. This starts with deep relationships fostered with capital providers and is bolstered by institutional-quality offering memorandums and proforma models as well as prompt and comprehensive responses to questions and information requests.

“It’s not just who you know, it’s how you get them to do your deal.”

Malcolm Davies | Founder, Way Capital

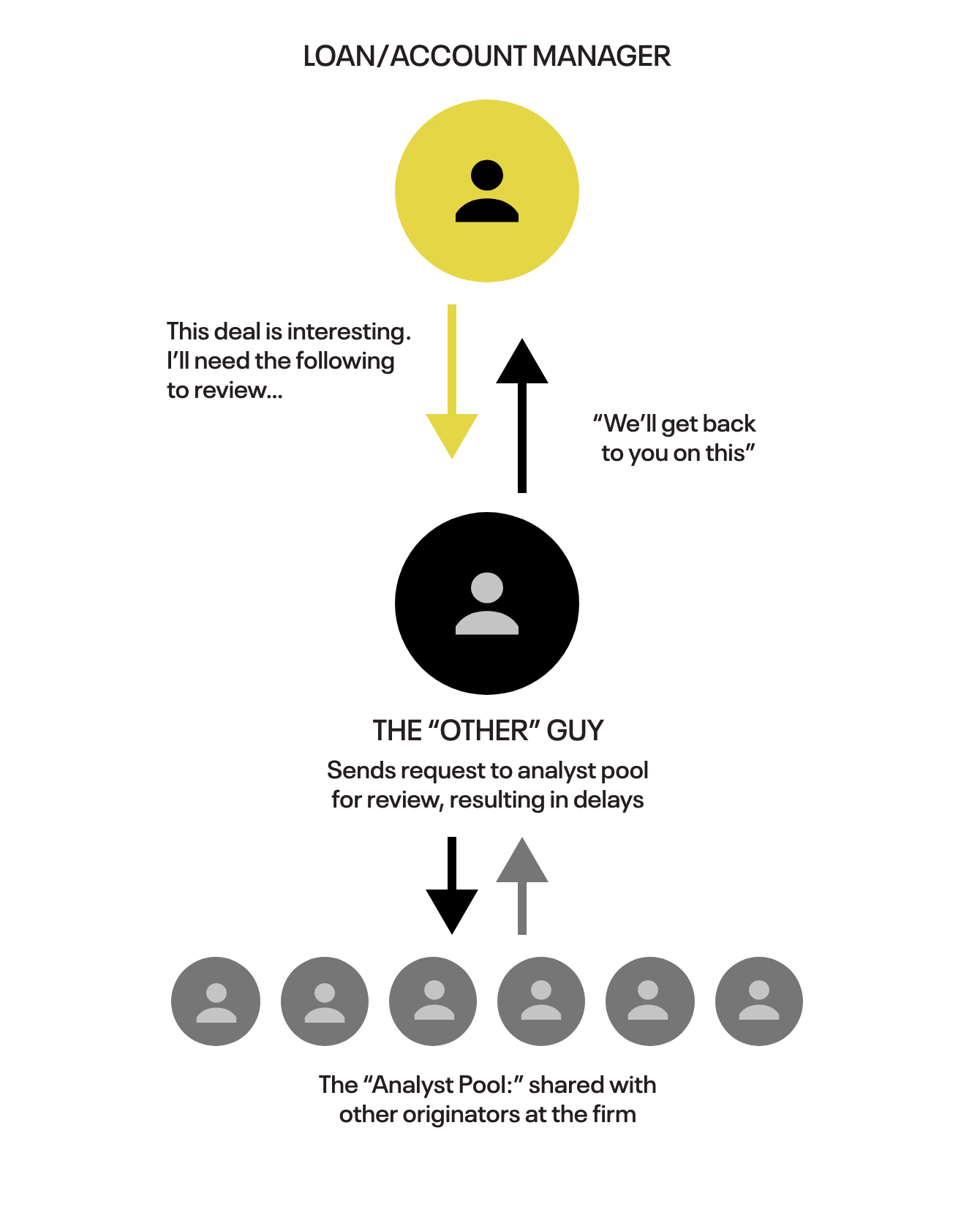

Dedicated Resource Model

Feel the power of our personnel.

Our fully integrated team structure allows us to swiftly and effectively allocate our resources, leveraging our team to find strategic solutions for our clients and continually build deal momentum. This structure empowers us to thrive on complex deals and differentiates us from our competition, who are constrained by sharing communal firm resources for underwriting, packaging, marketing and closing.

“The Eye” Capital Tracking

Stay informed throughout the deal.

Our reporting system enables detailed formal weekly reports and phone calls ensuring the regular flow of information and facilitation of regular strategy discussions.

Deal Sent & Follow Up

72-Hour Rule

The goal of our initial outreach is to have all capital providers respond within the first 72 hours so we can obtain early feedback and start a dialogue. This stage involves frequent communication to generate interest.

Acknowledge Receipt

Push Me to Review

Once acknowledged, our followup changes to figure out what we can do to build momentum with an individual capital provider and if additional items are needed to commence review.

Reviewing

Help Me Understand

This is a critical juncture. Our team zeros in on groups reviewing to figure out what questions need to be answered and what additional information can be provided to build momentum towards a proposal.

Soft Quote

We Liked the Deal

At this point, soft terms are issued or close to being issued. The focus is on vetting these terms with the sponsor and providing the capital source with feedback for internal approval toward a full term sheet.

Term Sheet Issued

Let's Get it Done

Formal approval received. Redlines and structure negotiations commence. The focus is on getting to a fully agreed upon and mutually executable application.

Off-Balance Sheet CFO

Embrace your entrepreneurial spirit with less risk.

Our clients leverage the power of our entire team without incurring the burden of additional overhead that this kind of access would involve at other firms. We can take on challenging projects and have the resources to build momentum in the capital markets where others cannot.

“The team did a fantastic job sourcing capital for our project. I was extremely impressed with the level of attention given by the team, the push for better terms, and the overall execution for a successful close. My expectations were definitely exceeded.”

Jason Lewis | Principal, Lazer Properties, Inc.